We all know automated fraud detection may create false positives. What should you do when they damage your business?

Fraud detection, like many other subsets of Risk Ops, is always a compromise between security and user experience. Push your security to the max, and you risk losing sales. Make it too lax, and you open the door to fraudsters.

Low security

High security

Bad customer experience

Good customer experience

Low false positives

High false positives

Low fraud rate

High fraud rate

But how do you strike the right balance good customer risk assessment and experience? And is there anything you can do to ensure your system gives the best results?

Worse Than Fraud Itself?

False positives cost businesses 13 times more than credit card fraud, which means a badly calibrated fraud detection system can hurt your business more than not having one at all. Share on XThe ultimate goal for most online businesses is to process transactions and to fight against chargeback fraud. Any declined sale hurts the company’s bottom line. Javelin calculated that US merchants can lose as much as $118B every year to false positives,

The number is particularly worrying for the following reason: it is 13 times that of the cost of credit card fraud, which means a badly calibrated fraud system can hurt your business more than not having one at all.

Customer Insult Rate and Reputation Damage

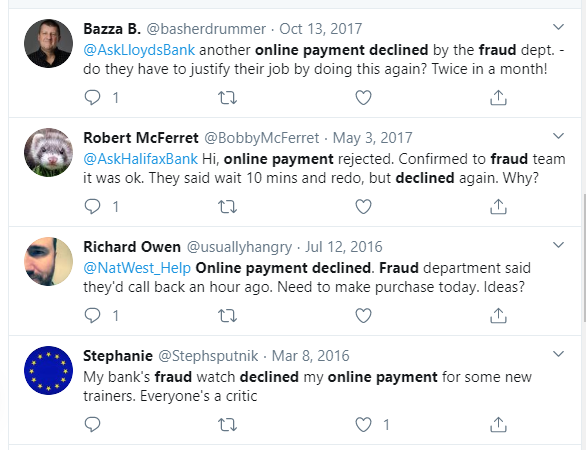

In the age of social media, online reviews and transparent practices, company management has every reason to ensure the customer experience is above par. And it’s easy to see how damaging it can be to frustrate customers, especially with declined card payments.

Their frustration, however, should be acknowledged. They probably spent hours researching the right product and considered multiple options before clicking the Buy button. Being allowed to onboard but not complete a transaction adds insult to injury, as a certain amount of personal information has already been given by that point — why couldn’t the extra security measures kick in before?

Moreover, a high customer insult rate isn’t just hurting sales and looking for improved services with your competitor. Their dissatisfaction often snowballs and has larger repercussions on your business, as American Express report shows that consumers tell an average of 11 people about their good experiences and 15 people about the bad.

Paired with unsatisfactory customer support, it’s easy to see why these customers take to social media and do their best to damage a business whose service they now see in a negative light — all of which started because the fraud detection system and the team made a wrong call.

When False Positives Impact Detection Accuracy

Last but not least, high false positives rates in fraud detection also creates a negative cycle, by corrupting your automated systems.

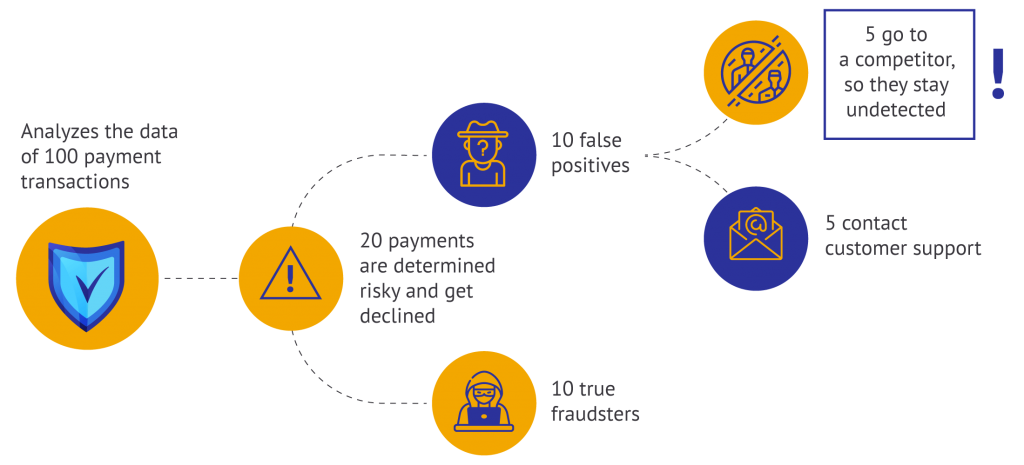

Here is an example of how it could happen:

The problem is that these 5 false positives are never marked as such by the system. Which means your anti-fraud detection tool is essentially calculating risk with flawed data analytics. This, in turn, decreases the accuracy of detection over time.

The Solutions: Data Enrichment, Error Matrixes, Machine Learning

Luckily for fraud managers, there are a number of tools available from providers to measure, identify, and reduce false positives.

Data Enrichment

The first one, data enrichment, also happens to be the easiest to use. It is particularly effective in the context of a multi layered fraud prevention approach.

But the key takeaway is that monitoring fewer customer data points can increase the risk of false positives. Data enrichment takes a small number of data points, finds them in external databases, and aggregates it all to give you a better idea of who you are dealing with.

For instance, working with an email address only, SEON Intelligence could tell you:

- The user’s real name

- If they registered on a free email domain

- How long they’ve been using the address

- If it’s linked to any known social media accounts

Combining data enrichment for email addresses, phone numbers, device and IP address can create a very complete view of the user, which is particularly useful when it comes to manual reviews.

Error / Confusion Matrixes

An error or confusion matrix is a tool used to measure the success rate of your statistical analysis. It can make rules pertaining to specific data like monetary value or time between clicks, and see how well these rules fared historically.

It is a very powerful visualization tool that helps understand the accuracy of your rules by looking at historical data, and tweak them or create new rules to reduce the false positives.

Machine Learning

The biggest challenge of fraud detection is that the rules of the game keep changing. This is due to four key factors:

- Fraud has a long tail distribution: there are too many unique cases to create specific rules for each

- The patterns change quickly: for instance, if you are an eCommerce, fraud will change seasonally and depending on your current inventory

- Fraudsters mimic good users: the constant game of cat and mouse means your software needs to update fast, and in real-time

- Fraudsters are adversarial: they actively look for weak spots in your line of defence to exploit your business

What should be immediately clear is therefore that your rules cannot be static, stale, and rigid. In short, you need AI to help with rules-creation – whether you want to win chargeback disputes or improve your PSD2 and SCA compliance.

But don’t be fooled into thinking implementing a machine learning system will immediately solve all your fraud detection problems. The key is to feed all the data to the software, but to let fraud managers oversee the manual reviews by giving the right tools, such as:

- Whitebox machine learning system

- Human-readable rules

These are all features we integrate into SEON’s Sense platform, designed to give you the full power of a machine learning engine, and the most intuitive dashboard to control it.

Don’t Let a Bad Fraud Management System Hurt Your Business

Fraud protection tools come in many shapes and forms these days, which is why choosing the right one is an important part of your Risk Ops strategy.

Does it let you enrich data? Are the rules too rigid to really help? Will it help win chargeback disputes? And will it create too many false positives that will eventually damage your business?

Answering these questions when you train fraud managers is just the beginning. You’ll then need to look at scaling options, pricing models, and advanced features. But hopefully, this guide on false positives will help you get a better idea of how to find the best technology and performance for your needs.

Get unprecedented insight into your customers’ true intentions by leveraging SEON’s unique digital footprint analysis, sourcing real-time data from 90+ social media and online platforms to gauge who’s real and who isn’t.

How Does It Work?