Payment card declines are frustrating to deal with.

You just spend a bunch of money to acquire a new customer, or re-activate an existing one, only for their purchase to be declined by the processor or their issuing bank.

This is a huge pain. 20-40% of customer churn comes from declined payments. And all you get is a vague reason and some non-standardized decline code.

But the customer will be angry at you.

You can do your best to mitigate this by preparing in advance, but you can also gain valuable, actionable insights from declines.

Deep Dive into Declines – Innocent or Not

Broadly speaking, declines come in two forms:

- Soft declines are more common, with straightforward reasons ranging from the customer having insufficient funds to a need for further cardholder authentication. These can be mitigated easily by retrying the payment, offering an alternative payment method or enabling harder authentication protocols. Soft declines originate from either the payment processor or the bank.

- Hard declines come straight from the issuing bank, meaning that the payment will fail even if re-attempted. These range from innocent mishaps like expired cards to the system blocking the payment because the card has been reported lost or stolen.

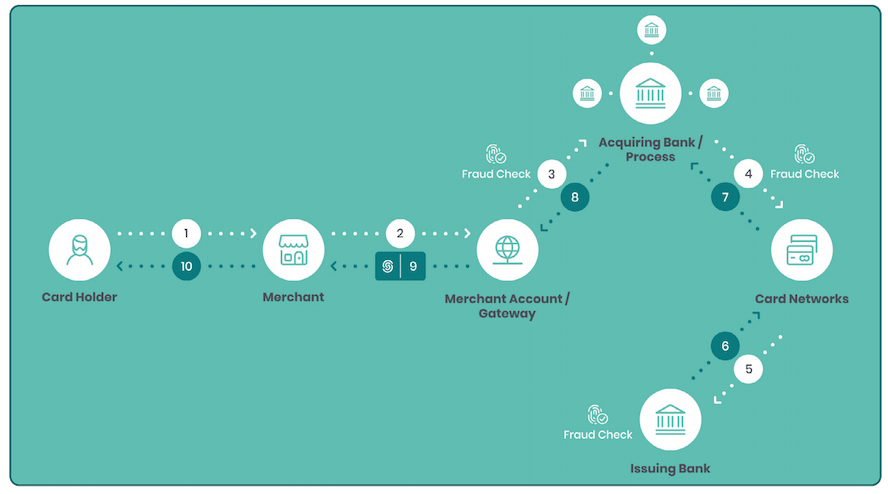

It’s important to understand that even with a simple credit card transaction, multiple players in the chain run their own risk checks.

And they also return different codes, though there are categories of codes that frequently come up despite who the stakeholder is.

Payment Decline Code Examples

In fact, different payment processors will have completely different lists of codes, though their reasoning will overlap. Here are some common types of payment declines.

| Insufficient funds | The customer doesn’t have enough funds to complete the transaction. |

| AVS/CVV error | The card details were correct, except for the AVS or CVV number. |

| Expired card | The card has expired. |

| Lost/stolen card | This card has been reported as lost or stolen to the bank. |

| Pick up card | The bank or payment processor is asking the merchant to pick up and retain the card (in addition to not approving the transaction). |

| Do not honor | The vaguest type of decline. The bank is indicating there is something wrong with the card but does not specify why. The cardholder is expected to contact the bank themselves to find out more. |

Vague Decline Codes: A Feature, Not a Bug

The main reason why decline codes are usually opaque is that none of the parties involved wants to pass on unnecessary information.

After all, you wouldn’t want to let a fraudster know that you know what they are up to, as that would lead to them changing their approach and perhaps succeeding on their next try…

As a business expands, this becomes a growing concern.

Here’s an Idea: Be Proactive

Monitoring acceptance rates means understanding your declines better as, if your decline rate is higher than average, this might land you in hot water with payment processors.

This is not just a problem if you have recurring payment schemes, which are often subject to stricter scrutiny. With 30% of credit cards in circulation expiring every year, this is a constant issue even if your customer has their card data saved (anywhere – from their account to their browser, etc).

The general idea then is to be proactive in how you handle declines.

On the one hand, you can seek out the best local payment options for a given market. You can rely on fallback processing partners in your payment cascade. You can also offer quick retries with stronger authentication, depending on the message you received.

All of this increases the chances of having a payment – and thus a sale – approved, or at least of keeping the customer informed.

(In the case of trusted customers, you can use SEON for PSD2 exemptions that can make the payment go through on the second try.

The system will be able to register when the shopper is logging on from a previously known device and/or location, which should signal that they should be trusted, so there is no need for SCA on your end.)

On the other hand, since the customer will blame you for their payment failing – and they will blame you for the payment failing – you have to be upfront in your communication. Whether the card has insufficient funds or has expired, you need to warn your customer and quickly offer them a workaround.

The worst of the decline codes you may receive and need to communicate is arguably the dreaded “Do Not Honor”, in which case the best you can do is ask the shopper to call their bank. But hey, at least you helped them figure out what’s wrong!

When it comes to recurring payments, it’s wise to proactively contact your customers if you can already see that the payment will decline. A typical example is when the card has expired already with the next billing period fast approaching.

Hard Declines Should Not be Hard to Deal With

Things become trickier with hard declines.

While it’s possible that the customer was just absent-minded during checkout and provided the details of an expired card, a hard decline can also indicate a fraudster.

While the SEON system is typically called before the transaction is completed, it is wise to send the result of the transaction back to SEON with all the necessary user details.

A customer trying to make purchases with different card BINs that are all coming back with hard decline messages is up to no good. They are obviously testing illegally acquired cards.

In such cases, it’s best to block them proactively. They’re either going to further erode your decline rate or worse.

If they eventually succeed in getting a payment through, you’re looking at a refund at best or a chargeback at worst.

While higher acceptance and approval rates are usually front-and-center problems for payment teams, the point is that declines are part of your customer journey.

If you don’t take them into proper consideration, consumers will punish you by bolting to the competition.

Worse yet, if you don’t monitor your payment declines as part of your anti-fraud efforts, you might be signaling that you have a pretty big security hole in your system that’s ready to be exploited – inviting all sorts of card testers onto your service.

Sources