Customer Screening & Monitoring

Screen Smarter.

Move Faster.

Stay Compliant.

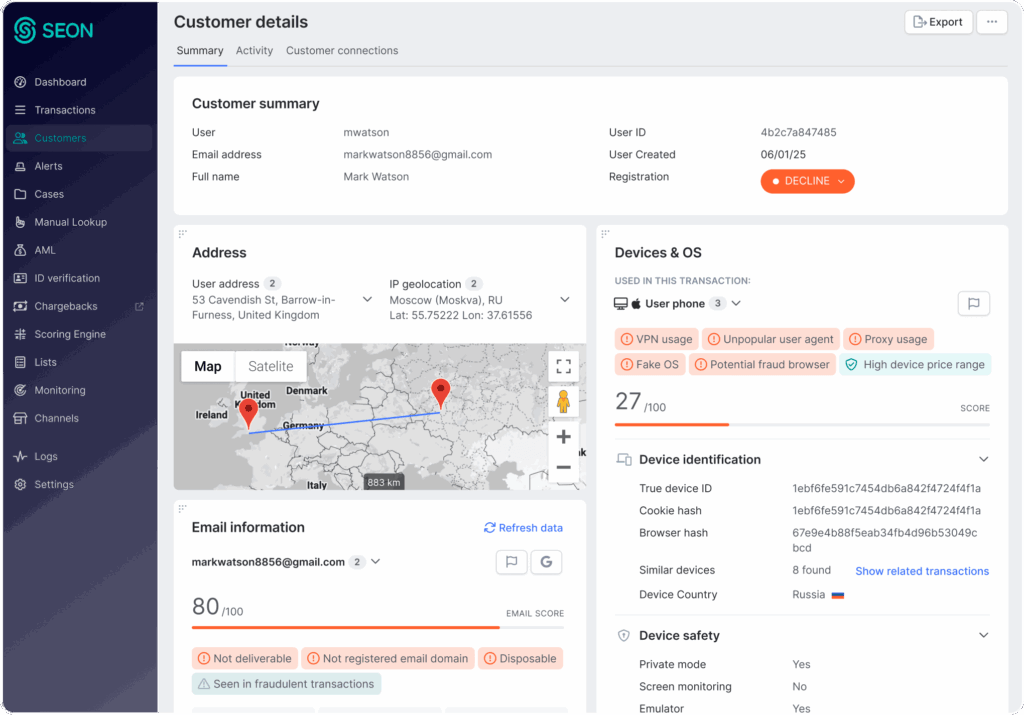

Use proprietary fraud signals to block risky users before AML checks and automate global customer screening and ongoing monitoring — all in real time, through a single API.

Trusted by the World’s Most Ambitious Companies

FROM BATCH CHECKS TO INSTANT INSIGHTS

Batch Screening Delays Detection

Legacy AML screening uses batch-based checks that delay detection and client onboarding. Manual reviews, exports and bottlenecks stall investigations and slow reporting. SEON automates AML screening, surfacing fraud signals before KYC to block bad actors earlier, so you can focus on real risk.

REAL-TIME SCREENING WITHOUT DELAYS

Automated AML Screening to Replace Slow, Batch-Based Checks

Pre-Screen Bad Actors Before KYC

Screen Customers in Real Time

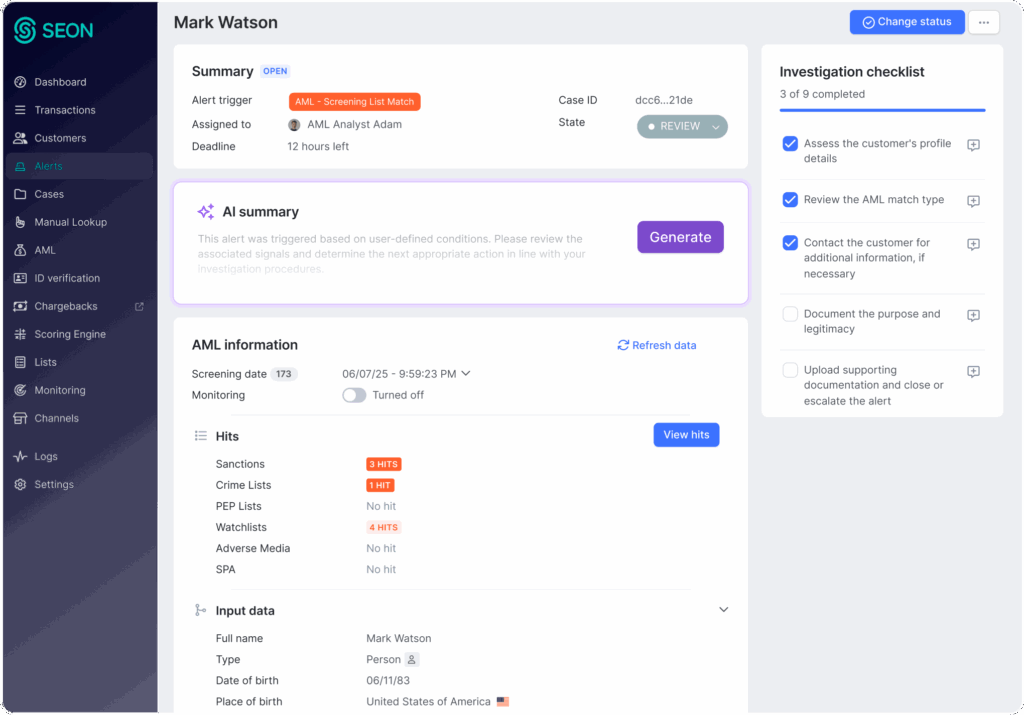

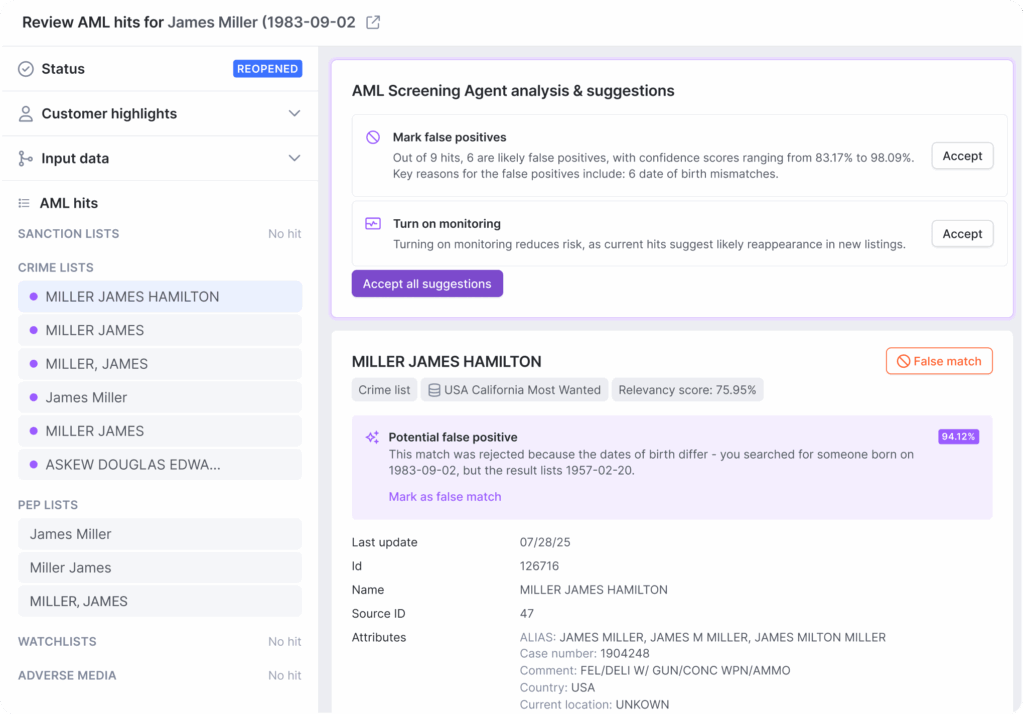

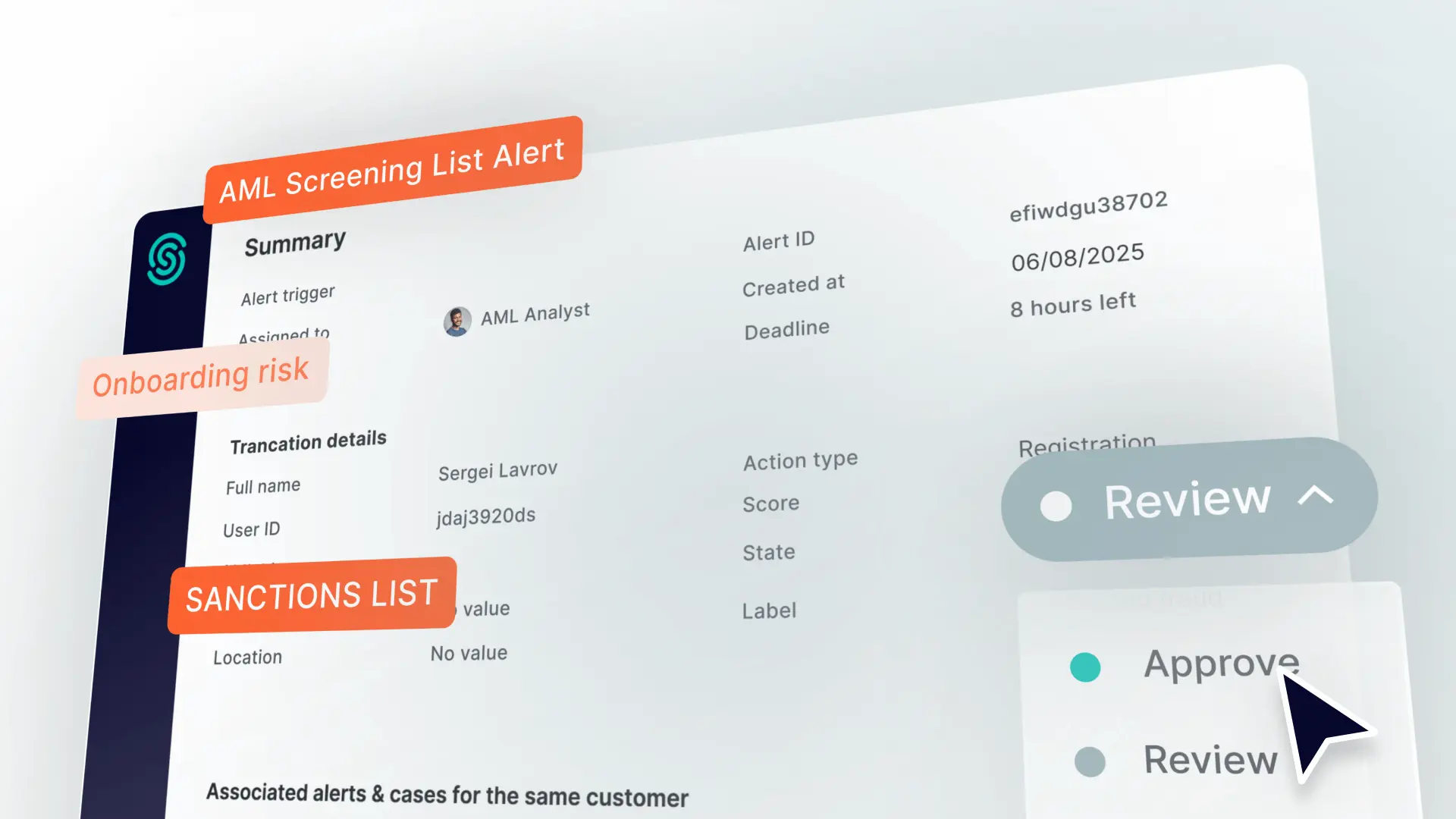

Review Hits With an AML Screening Agent

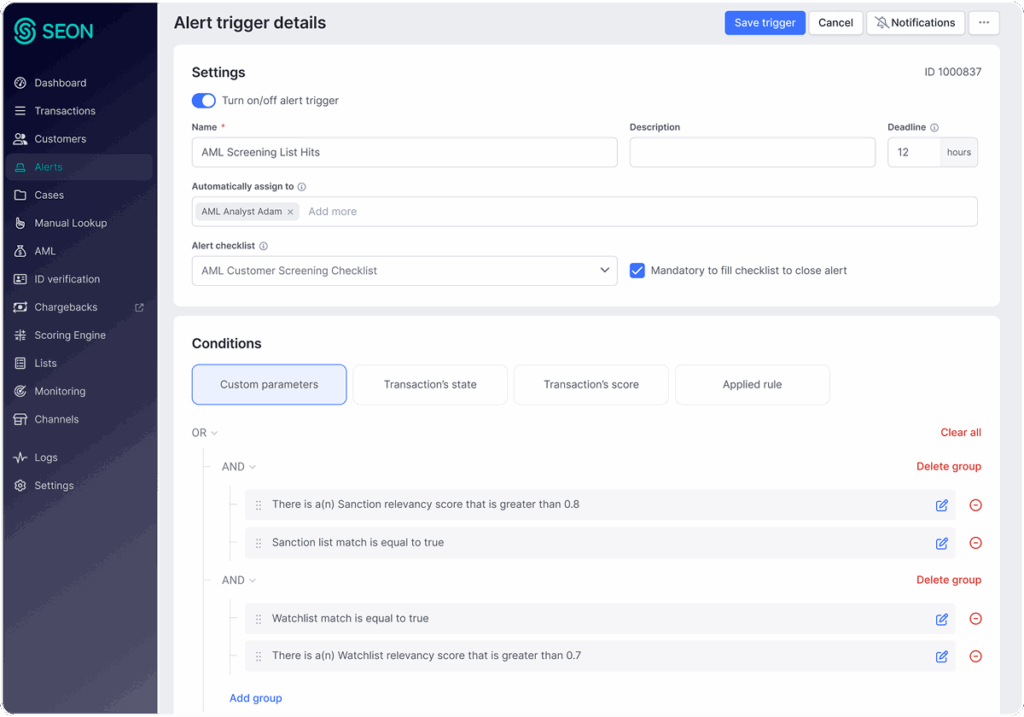

Create Rules & Alert Trigger Logic Your Way

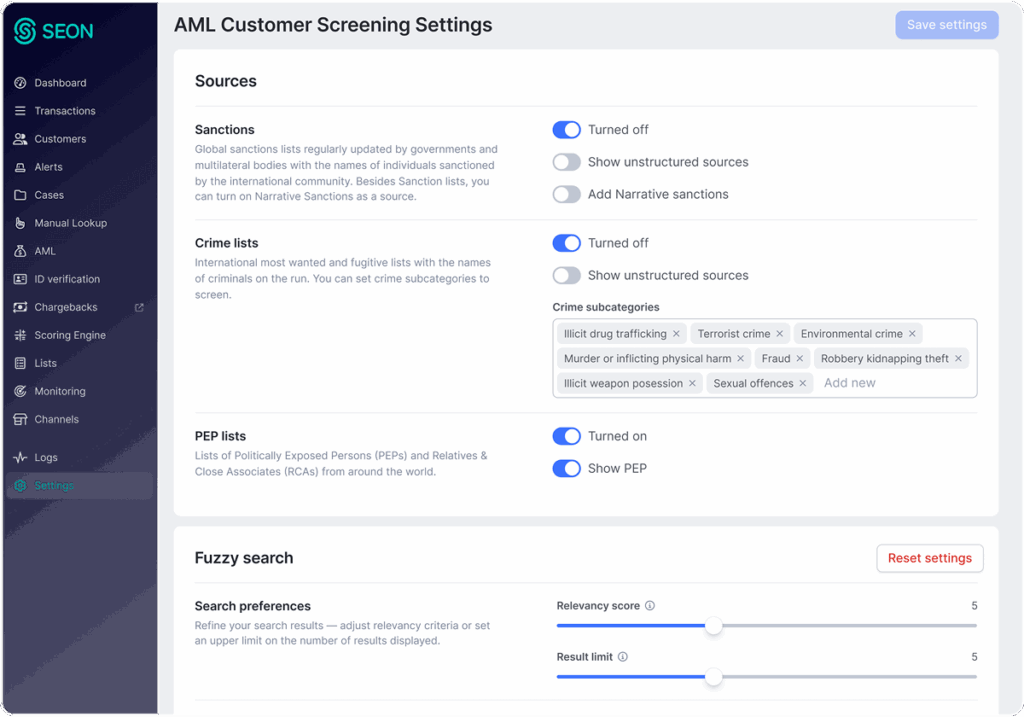

Customize & Automate Monitoring

Integration

Quickly Integrate Using a Single API

Launch AML screening, transaction monitoring and case management using a single API. All solutions are natively integrated to deliver full compliance functionality in one solution.

Take a Tour of Our Real-Time Solution

Learn More About Customer Screening

-

See how real-time screening boosts AML compliance, cuts risk, and helps firms avoid fines and costly gaps.

-

See how sanctions screening supports AML compliance. Explore the process, key steps, and tips to stay ahead of regulatory risk…

-

Find out why PEP checks are required and how to do them more easily.

-

Learn how sanctions screening software detects sanctioned transactions, ensures compliance, and reduces financial crime risks in this guide.

-

Learn what AML screening is, how it works, key types and sanction lists, and why it matters for compliance.

-

Understanding and mitigating customer risk is pivotal to sustaining growth and maintaining a competitive edge. Customer risk assessment serves as…

Customer Screening FAQs

Absolutely. SEON lets you define custom rules and alert triggers using any combination of behavior, geography, user segments and data attributes, giving you precise control over how and when screening is triggered.

You decide the cadence. SEON supports fully customizable re-screening intervals, including daily, weekly, monthly, quarterly, twice a year or yearly. You can also trigger re-screening based on events, like profile changes or new data becoming available.

Yes. SEON gives you full control over fuzzy matching sensitivity, enabling you to adjust search preferences, including edit distance, phonetic thresholds, language-specific filtering, date of birth filtering, and adverse media. You can fine-tune thresholds to reduce false positives while still catching close or transliterated matches, helping analysts focus on meaningful alerts.

Yes. SEON uses the same single API as its fraud prevention tools, giving you access to AML screening, transaction monitoring, and case management in one integration. All solutions are natively connected, so you can quickly launch real-time screening and ongoing monitoring without stitching together separate systems or disrupting existing workflows.

Take Back Control By Automating Customer Screening & Monitoring

“SEON’s robust customer screening, analytics and risk management system offers customizable options for setting relevance thresholds and reducing false positives.”

Monika Zaja, Fraud Manager YSI

Trusted by 5,000+ global organizations:

Speak With a Risk Expert

This form may not be visible due to adblockers, or JavaScript not being enabled.