AML Transaction Monitoring

Monitor in real time. Investigate on your terms.

Real-time detection meets practical flexibility. Gain unmatched control with flexible rules and detect, investigate and file regulatory reports — all in one place, without changing how your team operates.

Book Time With Our Experts

This form may not be visible due to adblockers, or JavaScript not being enabled.

Trusted by the World’s Most Ambitious Companies

The Shift to Real-Time Detection is Here

According to SEON’s latest report, 62% of companies are shifting to real-time transaction monitoring to better detect evolving risks. But compliance teams can’t flip a switch — they need tools that support flexible reviews, aligned with existing SLAs and workflows.

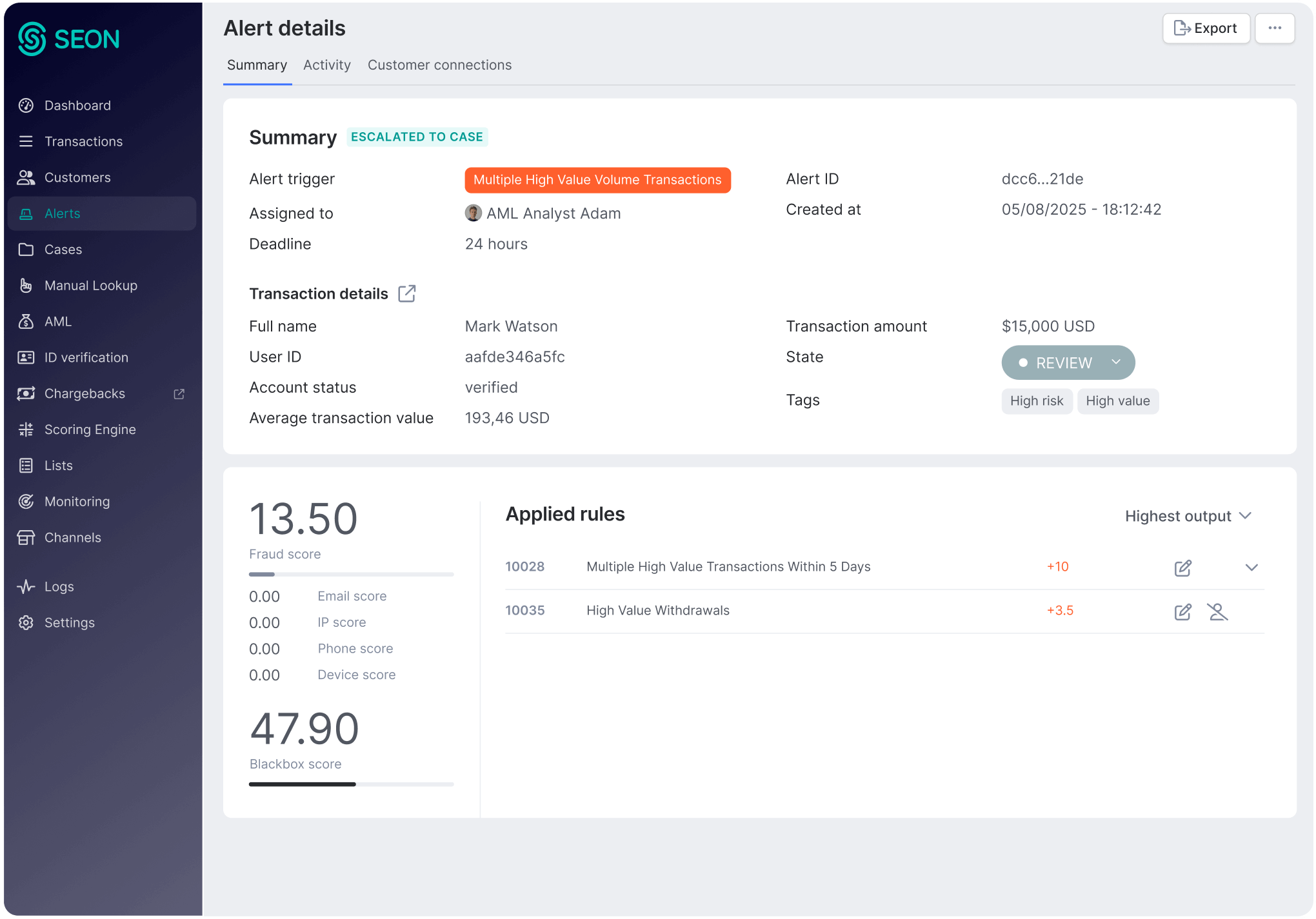

Spot Risky Behavior in Real Time

Instantly surface suspicious activity by analyzing behavioral and customer data alongside thousands of fraud and AML signals to catch money laundering tactics.

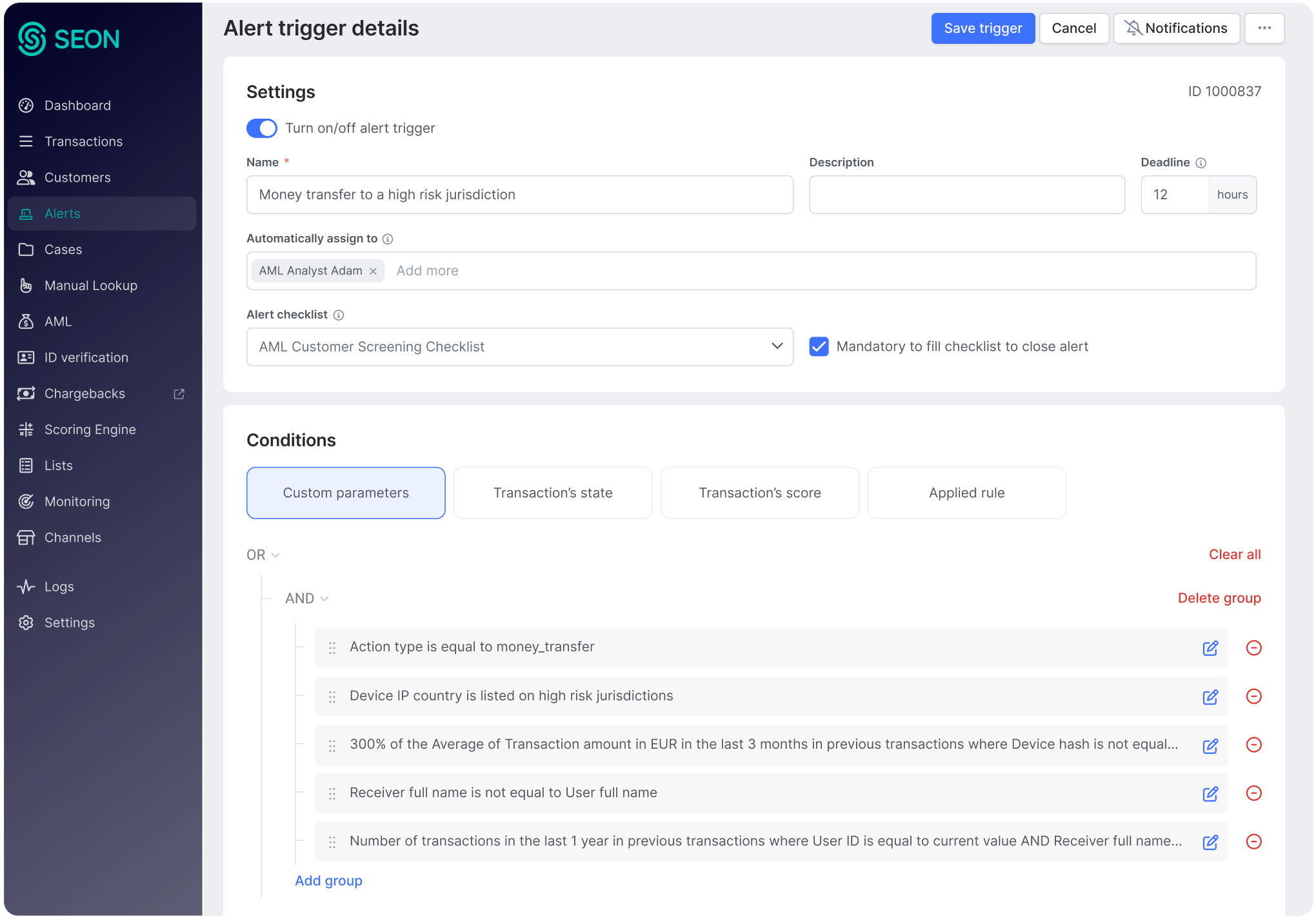

Build Targeted Alert Triggers & Rules

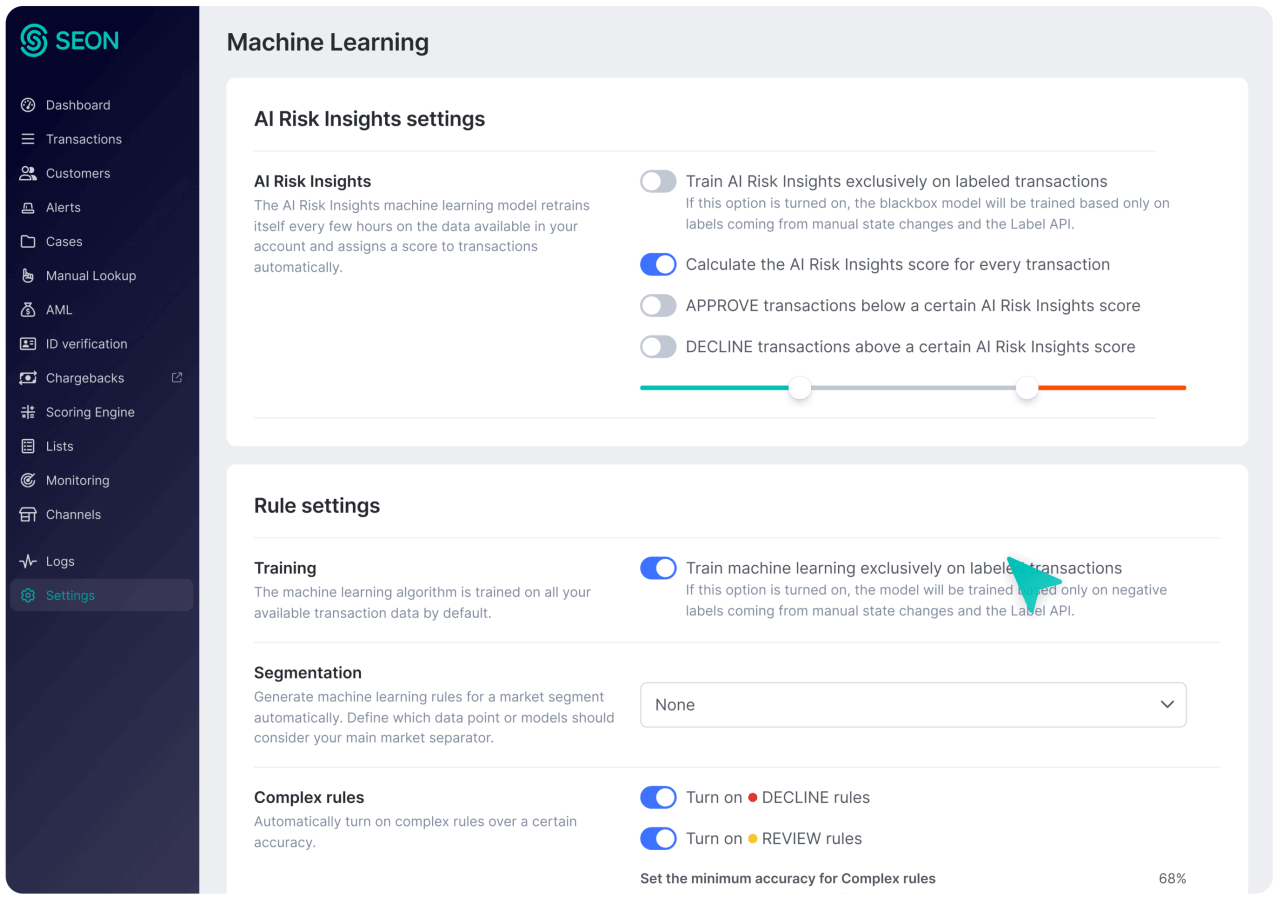

Create every alert trigger and rule imaginable with fraud, AML and behavioral data risk signals. Build advanced velocity rules, use prebuilt AML rules or tailor logic to fit evolving threats and internal policies.

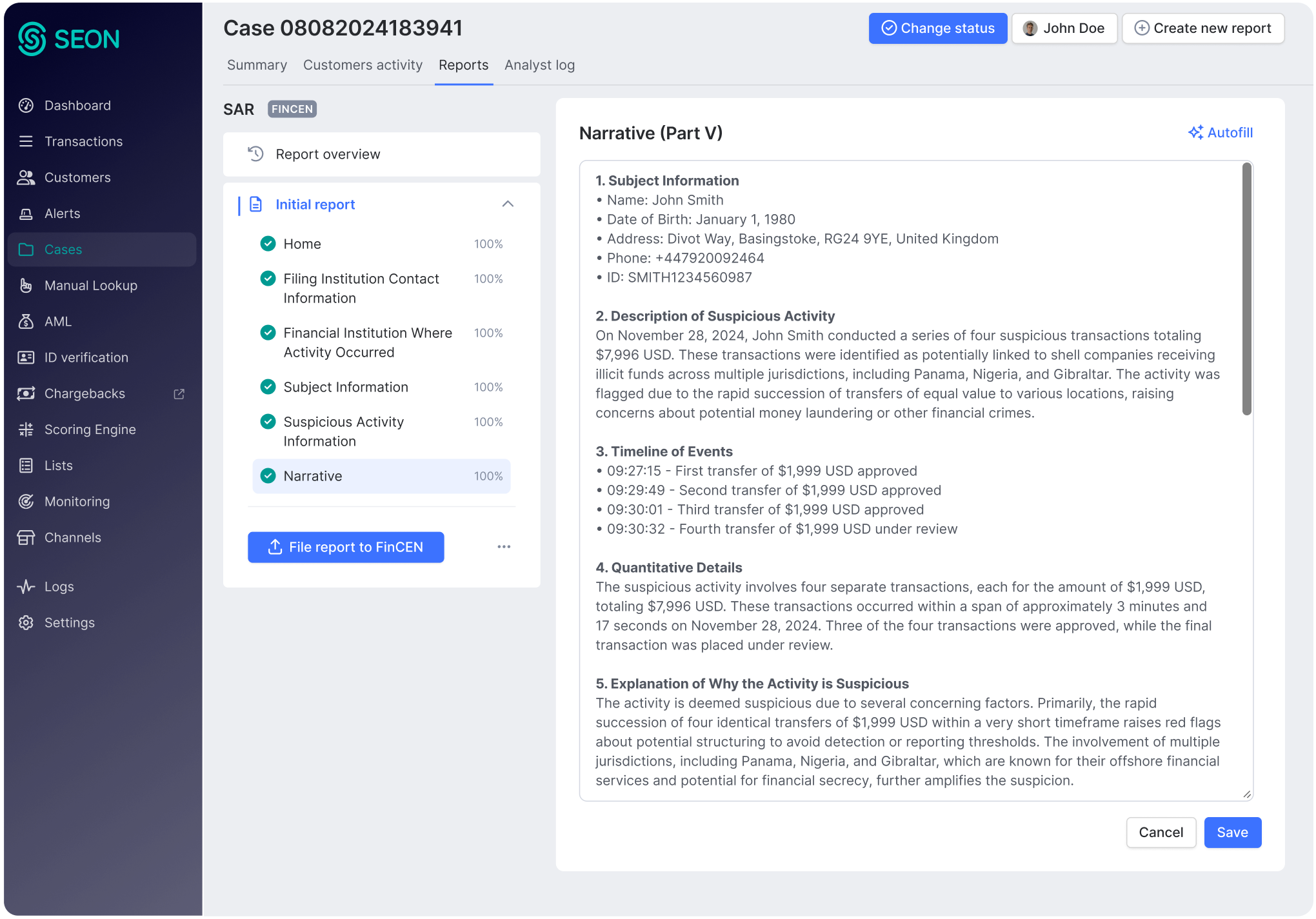

Simplify Investigations & Filing

Route alerts by priority, risk or SLA. Annotate cases, add evidence, collaborate and file SAR, CTR and Form 8300 reports directly to FinCEN — all with full audit trails.

AI TOOLS

Move From Investigation to Action Faster Using AI Tools

Detect Fraud Patterns That Human Eyes Can’t

Take a Tour of Our Real-Time Solution

See How Our Customers Stop Money Laundering

“It is a robust analytics and risk management system that offers customizable options for setting relevance thresholds and reducing false positives. This system seems particularly useful for compliance purposes, allowing the team to monitor customer behavior, background, and appearances on lists for various reasons.”

Monika Zaja

Fraud Manager, YSI

“It is a flexible tool that helps us track possible money laundering activity with features that are highly customizable and help a lot with automation. The high number of sources that the feature has allowed analysts to consider their decisions from different perspectives. This allows the relevant teams to further their knowledge of the customers and for the company to stay compliant.”

Márton Hajagos

Fraud Analyst, Patrianna

The #1 Fraud Prevention and AML Compliance Solution Loved by Fraud & Risk Teams

With almost 350 reviews, SEON is the market leader and G2’s best fraud prevention solution.

Learn More About AML Compliance

-

Alert overload hurts compliance—discover how smarter AML rules catch real threats faster.

-

Still using batch compliance? You’re handing fraudsters a head start. See why real-time is the future—and how to stay ahead.

-

Learn how real-time AML transaction monitoring helps detect suspicious activity. Use automation to boost compliance and cut risk.

RELATED SOLUTIONS

Customers Like You Also Use

Payments Screening

Protect your business from fraudsters and linked accounts by continuously analyzing real-time device and behavioral data points to block them – earlier than ever.

Case Management

Replace manual processes and fragmented tools with an AI-supported case management solution that automates workflows and enables direct, one-click regulatory reporting for your entire team.

Customer Screening & Monitoring

Keep your business and your revenue safe with anti-fraud and global AML screening, continuous monitoring, and rule-setting capabilities.

Frequently Asked Questions

Yes. SEON lets you tailor every alert trigger and rule to your internal risk appetite, compliance policies and regional obligations all without writing code. You can adjust rule thresholds, select which data signals to use, and define conditions based on fraud, AML, or behavioral insights to fit your evolving needs. You can read more about rule recommendations and AML transaction monitoring here.

Absolutely. SEON surfaces suspicious activity by analyzing transactions in real time using behavioral patterns, customer context and AML signals. This helps teams move beyond batch reviews and take immediate action when needed.

SEON reduces alert fatigue by letting you set highly specific, granular rules and alert triggers for every scenario imaginable that focus on true risk, not noise. By layering fraud signals (like IPs and devices) with AML and transactional data, analysts can better prioritize alerts and avoid wasting time on low-risk activity.

Yes. SEON supports direct filing of SAR, CTR and Form 8300 reports to FinCEN. Reports are pre-filled from case data and include audit trails and submission status, saving time and reducing the risk of manual errors.

You can define transaction thresholds using SEON’s no-code rule and alert trigger builder. Rules and alert triggers can be set by amount, frequency, velocity and even behavioral triggers. Adjust thresholds per user segment, jurisdiction, product or business scenario to stay aligned with your internal controls and regulatory requirements.

Automate Transaction Monitoring in Real Time

“SEON’s flexible AML Compliance solution helps us track potential money laundering with highly customizable, automated features.”

Marton Hajagos, Fraud Analyst Patrianna

Trusted by 5,000+ global organizations:

4.7

4.9

Schedule your meeting

Connect with a fraud prevention and AML compliance expert on a strategy tailored to your business needs.

This form may not be visible due to adblockers, or JavaScript not being enabled.