Case Management

Resolve Fraud & AML Investigations More Efficiently

Replace spreadsheets, siloed tools and manual processes with an AI-supported case management solution that automates workflows and enables direct, one-click regulatory reporting – no hidden costs.

Book Time With Our Experts

This form may not be visible due to adblockers, or JavaScript not being enabled.

Trusted by the World’s Most Ambitious Companies

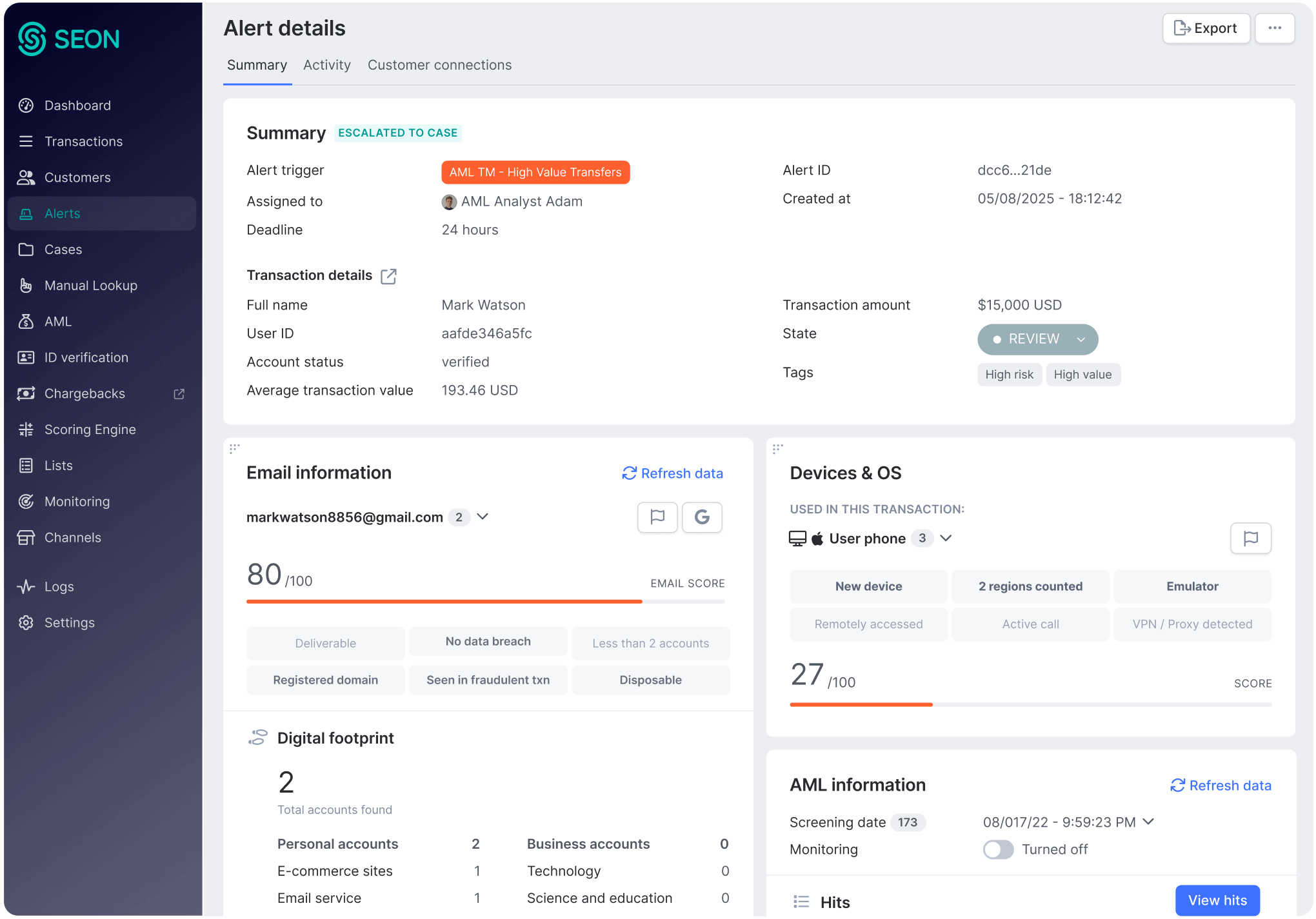

Investigations are Faster When Your Data is Connected

Most AML teams rely on spreadsheets, emails and siloed tools that slow reviews and delay reporting. SEON brings fraud and AML signals into one place — giving teams the context they need to act fast.

Close Alerts & Cases Faster

Cross-check AML data with 900+ first party data signals — building rich, contextual profiles that speed up investigations.

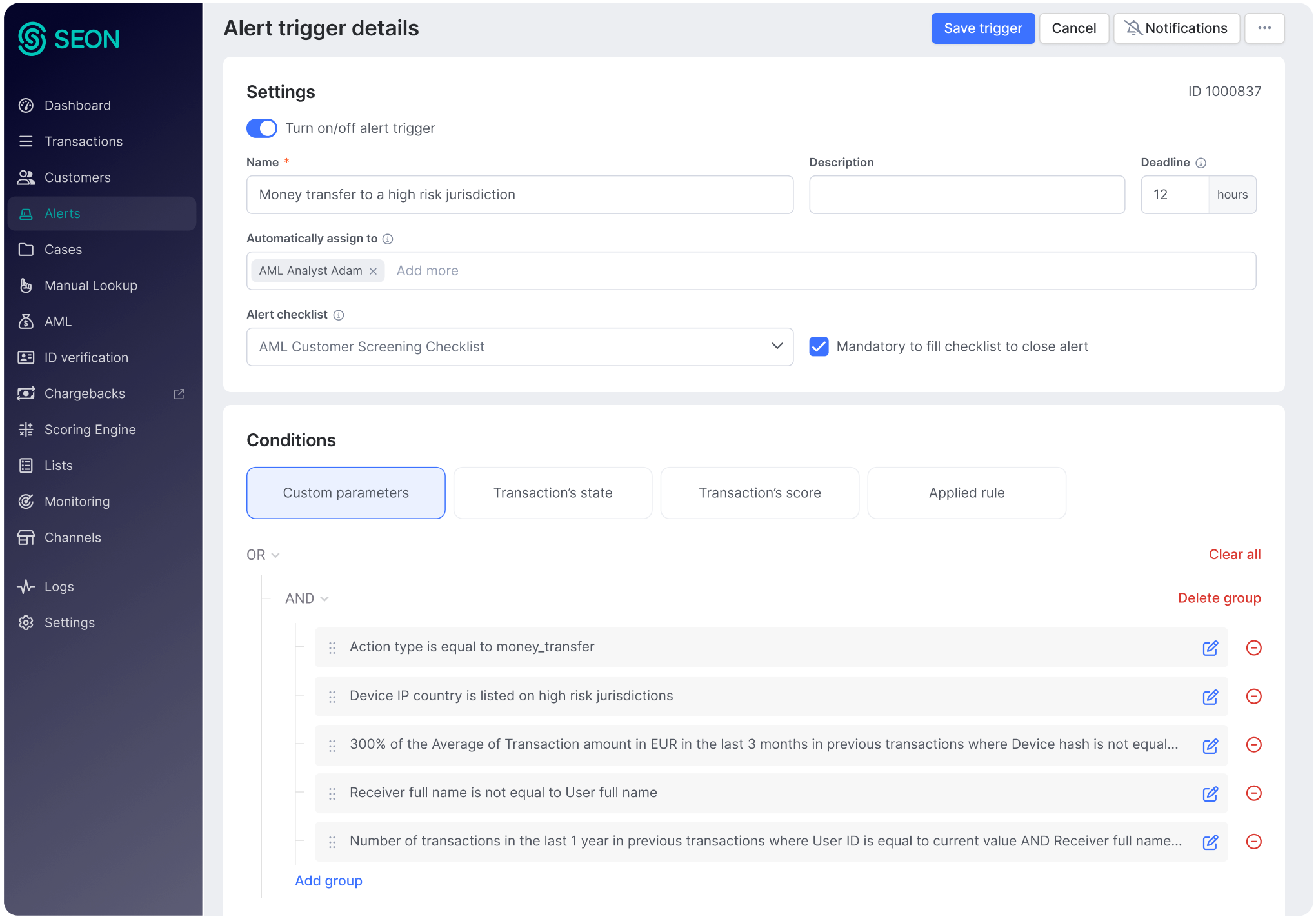

Automate & Standardize Investigations

Route alerts based on workload or expertise and create custom checklists to ensure every case follows the right procedures.

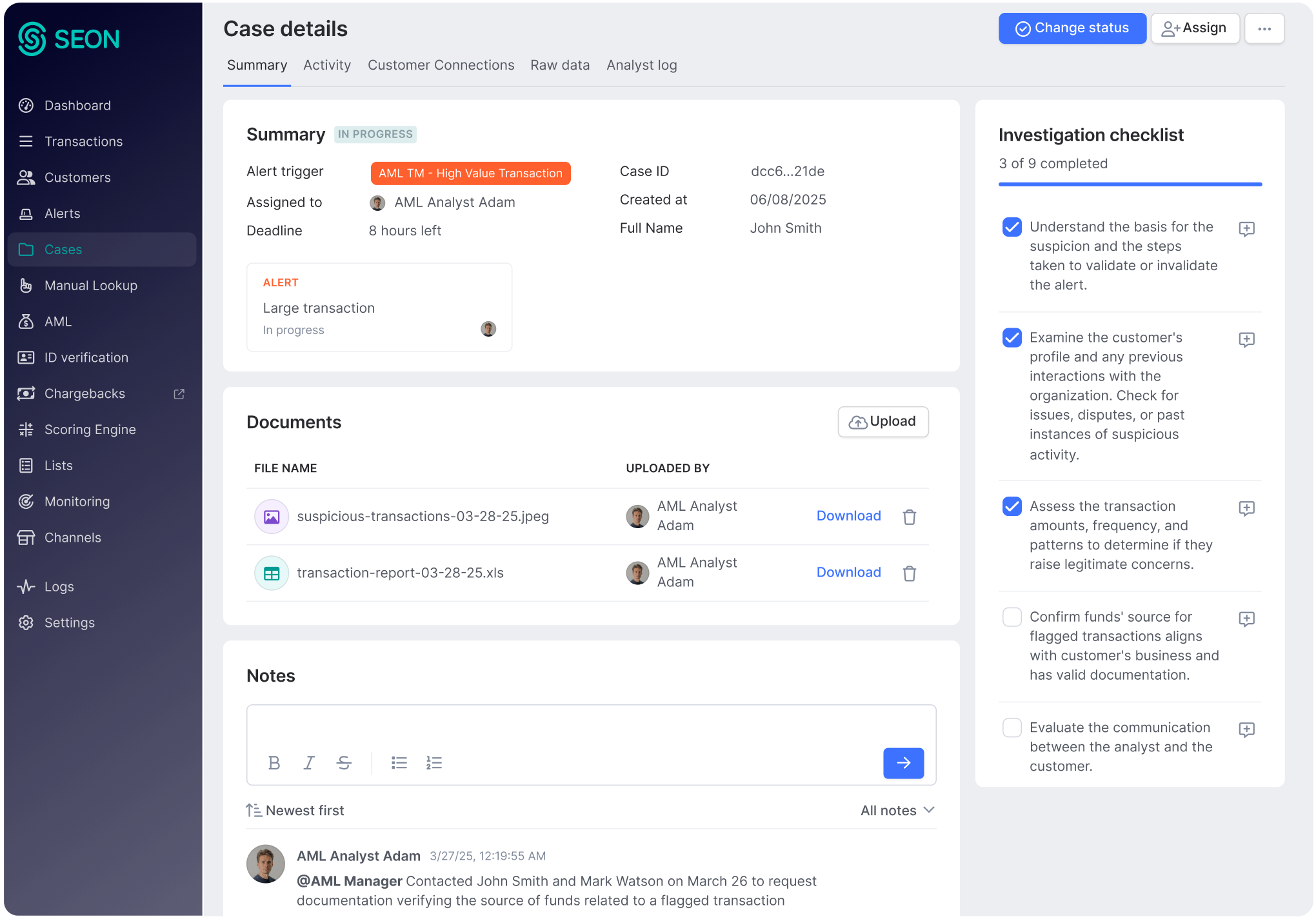

Collaborate Better in One System

Keep fraud and AML teams aligned in one system. Add notes, files and comments to create audit-ready, case histories.

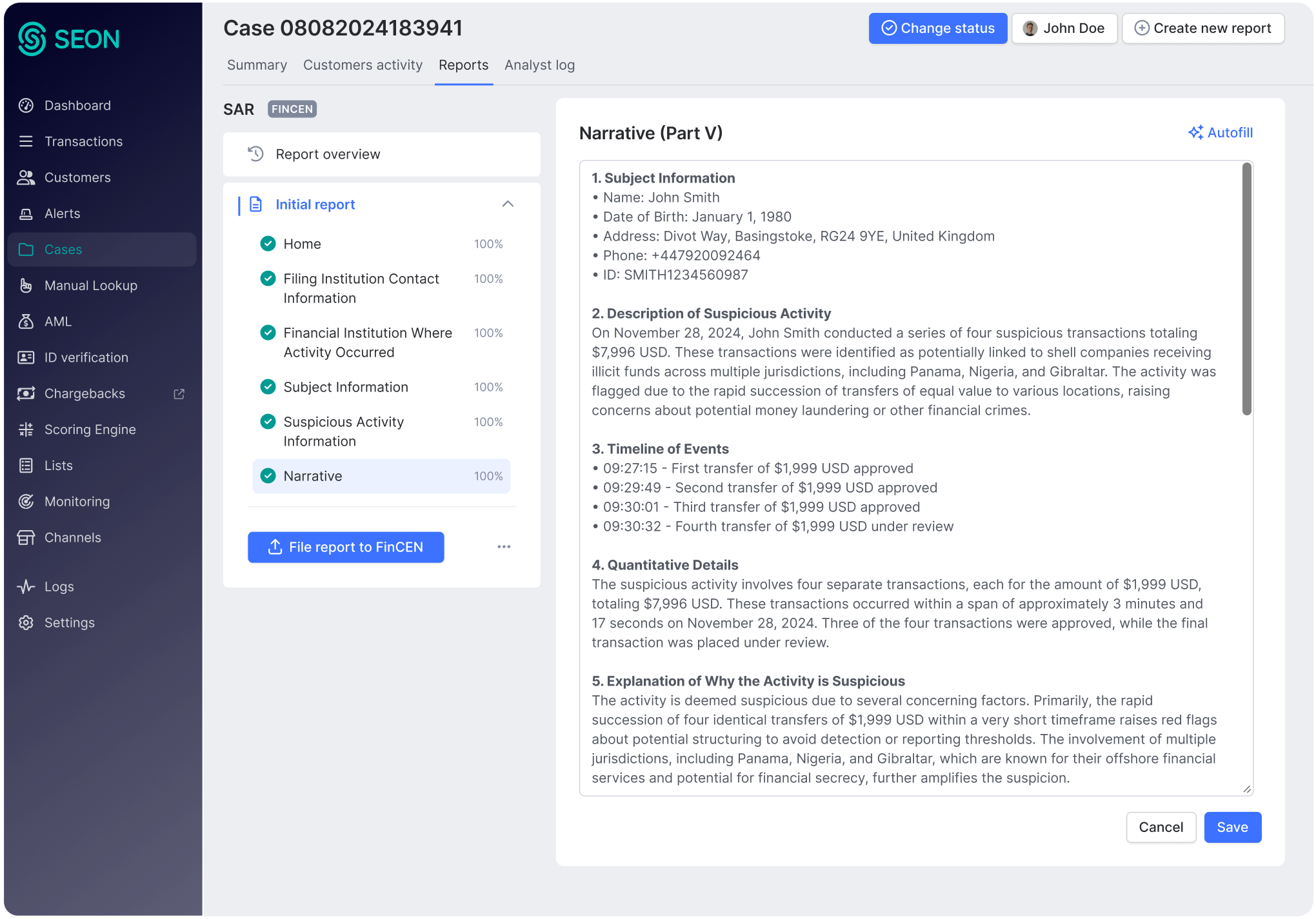

Save Time Filing Regulatory Reports

Use AI to autofill regulatory forms and write SAR narratives. File SARs, STRs and Form 8300s directly to FinCEN in one click, track statuses and maintain a full audit trail.

Take a Tour of Our Real-Time Solution

See How Our Customers Stop Money Laundering

“Ensuring robust fraud and money laundering prevention and AML compliance is a top priority. SEON’s advanced rules, alerts and case management tools have simplified our investigative processes. Its real-time alerts allow us to quickly identify and assess suspicious activity, while the case management system provides a structured, intuitive workflow for thorough investigations.”

Andria Georgiou

Money Laundering Reporting Officer, Nicheclear

“It is a flexible tool that helps us track possible money laundering activity with features that are highly customizable and help a lot with automation. The high number of sources that the feature has allowed analysts to consider their decisions from different perspectives. This allows the relevant teams to further their knowledge of the customers and for the company to stay compliant.”

Márton Hajagos

Fraud Analyst, Patrianna

The #1 Fraud Prevention and AML Compliance Solution Loved by Fraud & Risk Teams

With almost 350 reviews, SEON is the market leader and G2’s best fraud prevention solution.

Learn More About AML Compliance

-

AML case management streamlines investigations, enhances compliance, and integrates fraud detection for efficient financial crime prevention.

-

Integrating fraud insights into AML workflows streamlines compliance, reduces costs, and improves risk monitoring.

-

Alert overload hurts compliance—discover how smarter AML rules catch real threats faster.

RELATED SOLUTIONS

Customers Like You Also Use

Customer Screening & Monitoring

Keep your business and your revenue safe with anti-fraud and global AML screening, continuous monitoring, and rule-setting capabilities.

Transaction Monitoring

Analyze millions of transaction patterns in real-time using AI so you can identify and deter risk and fraud earlier.

Digital Footprint

Using email, phone, and IP data collected during onboarding, SEON crafts a highly detailed digital footprint of each user so you can detect fraudsters before KYC.

Frequently Asked Questions

Yes. SEON supports direct filing of SARs, STRs and Form 8300 reports to FinCEN. Regulatory report forms are auto-filled using alert and case data and SAR narratives are drafted based on the same context helping your team submit accurate, consistent reports faster and with less manual effort. You’ll also have a full audit trail for all submissions, including amendments and status tracking.

SEON unifies fraud and AML signals in a single case file, letting analysts investigate alerts faster with full context. Automated alert routing, customizable checklists and built-in collaboration tools help teams close cases faster without switching systems or losing the thread.

SEON uses AI to auto-generate SAR narratives and regulatory report form information based on alert and case activity, reducing manual effort and ensuring consistency.

Absolutely. SEON was built to support both fraud and AML workflows in a single system. Fraud analysts and compliance teams can collaborate on shared cases, access the same data and avoid duplicated work, helping unify investigations across the organization while maintaining distinct roles.

Traditional case reviews rely on spreadsheets, siloed systems and manual data gathering. SEON centralizes all information in one place, automates alert triage and provides AI-assisted regulatory reporting, helping teams investigate and resolve alerts faster, even with lean resources.

Resolve Fraud & AML Investigations More Efficiently

“SEON’s flexible AML Compliance solution helps us track potential money laundering with highly customizable, automated features.”

Marton Hajagos, Fraud Analyst Patrianna

Trusted by 5,000+ global organizations:

Speak With a Risk Expert

This form may not be visible due to adblockers, or JavaScript not being enabled.