AML Compliance in Canada

Protect Your Customers From Fraud & Stop Money Laundering

Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), which went into effect on April 1, 2025, has expanded and accelerated compliance obligations for a wider range of businesses, including fintechs, online lending and payments.

Book Time With Our Experts

This form may not be visible due to adblockers, or JavaScript not being enabled.

Trusted by the World’s Most Ambitious Companies

Why SEON for Fintechs, Online Lending and Payments AML Compliance in Canada?

SEON gives you the tools to confidently prevent fraud and money laundering risks, detect suspicious activities and support your efforts to meet regulatory obligations.

Detect high-risk behaviors

Detect high-risk behaviors: synthetic identities, disposable emails, suspicious IPs and device manipulation

Block suspicious actors

Block suspicious actors before KYC screening, reducing onboarding costs and streamlining the customer experience

Automate customer screening

Automate customer screening against PEP, sanctions, watchlists and adverse media

Detect threats instantly

Detect threats instantly with real-time transaction monitoring and payment screening

Speed up regulatory reporting

Speed up regulatory reporting with autofill capabilities and AI-powered SAR narratives

Maintain audit trails

Effortlessly maintain an audit trail and robust recordkeeping

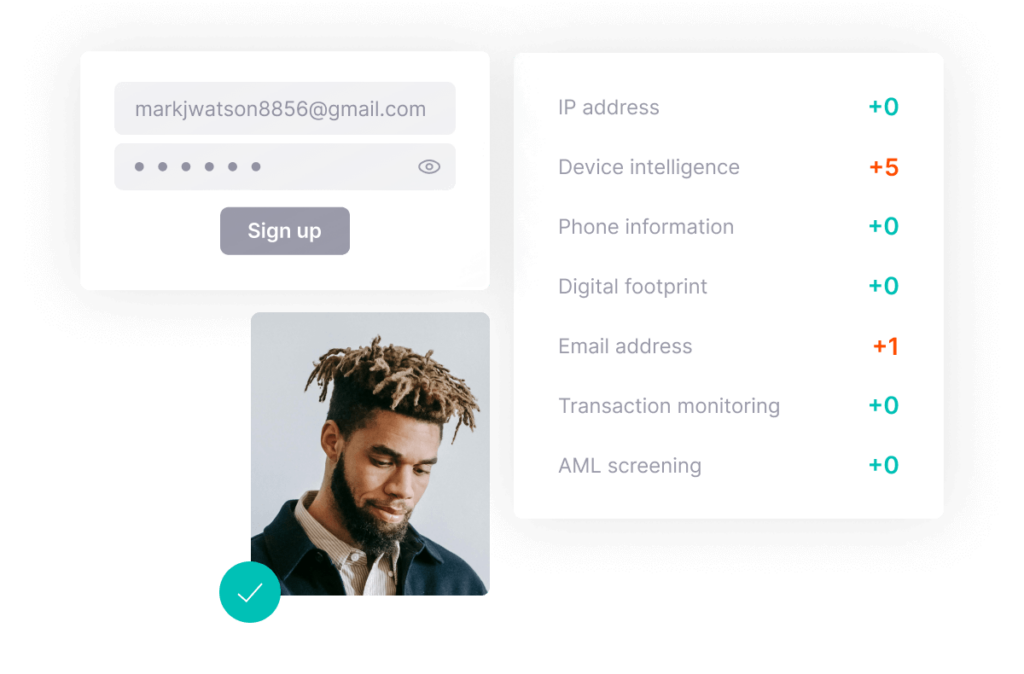

Secure Your Onboarding

From the first click for a loan application or account creation, instantly flag or block high-risk applicants using digital footprint analysis and device intelligence before global AML checks.

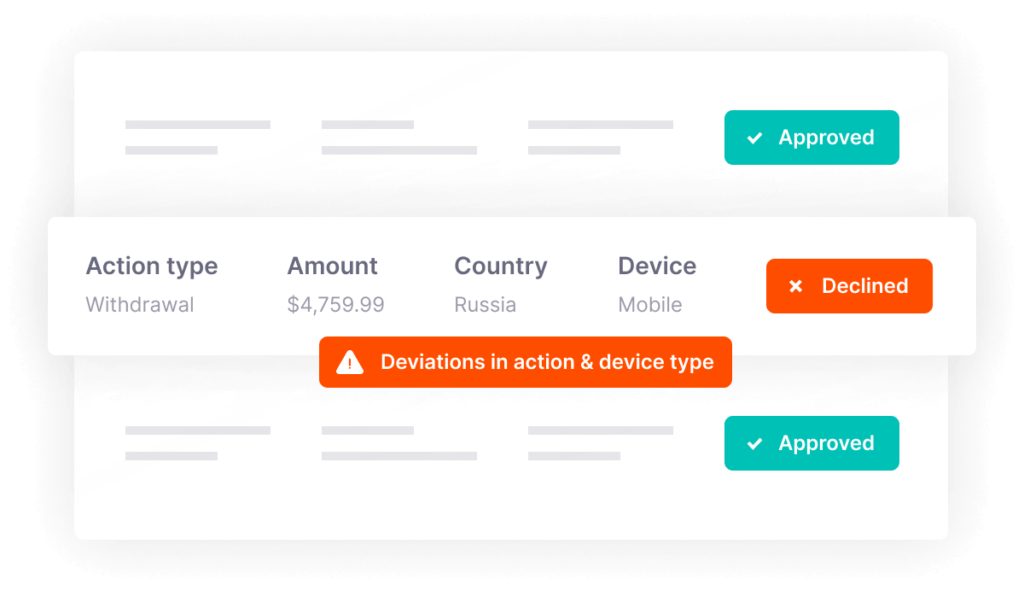

Monitor User Activities in Real Time

Analyze high-volume transaction activity in real time to spot anomalies, such as sudden large deposits and repayments above defined AML risk thresholds.

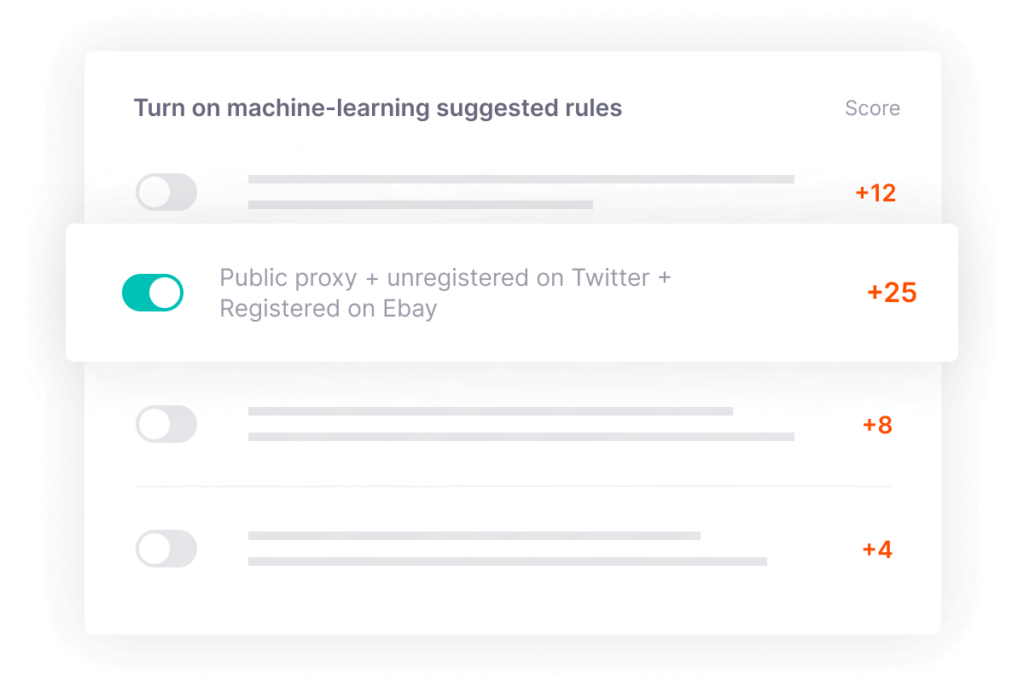

Analyze AI-Driven Insights

Leverage machine learning to create or refine rules that detect fraud and AML risks. Adapt quickly to threats and regulatory expectations using a codeless rule builder, reducing manual reviews and streamlining processes.

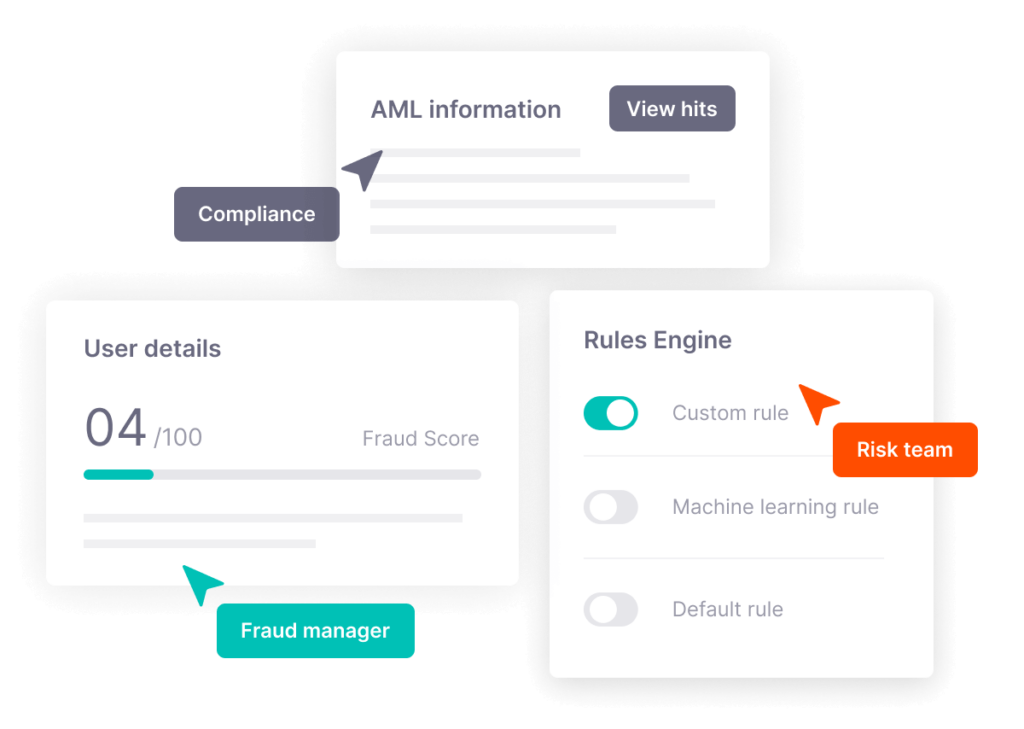

Unite Your Fraud, Risk and Compliance Teams in a Single Platform

Collaborate efficiently across teams, automate customer screening, transaction monitoring and maintain detailed records for every transaction to meet PCMLTFA requirements, including reporting to FINTRAC.

“We were looking at another provider, but they came back to us with a 4-6 months integration window. With SEON, it was literally a phone call, sandbox tests on Monday and by the end of the week, it was done.”

Coert Snyman, Senior Analyst, NOTYD

5 days

to integrate and onboard

87%

drop in fraudulent transactions

“SEON improves our accuracy by an extra 200 basis points. That doesn’t sound like a lot, but we are talking about 200 bpis of fraud cases we would be losing otherwise. And it’s often the last few points that are so hard to win as we fine-tune our models.”

Dmitri Lihhatsov, Fincrime Product Owner, Revolut

200

basis points increase

8x

ROI cost-effective pay-per-API call

“With SEON, you can reduce bonus abuse, making marketing spend more efficient and giving teams better visibility into campaign success. Working in real time is a key difference, and to top it off, the customer support is excellent.”

Joeran Kiencke, Manager Risk Operations, Lottoland

32x

ROI by safeguarding marketing campaigns from bonus abuse

190%

increase in multi-accounting detection at registration

The #1 Fraud Prevention and AML Compliance Solution Loved by Fraud & Risk Teams

With almost 350 reviews, SEON is the market leader and G2’s best fraud prevention solution.

Solutions

Comprehensive Fraud Prevention Tailored for Every Industry

Frequently Asked Questions

SEON is trusted by over 5,000 businesses globally — from financial services, fintechs and payments to iGaming and eCommerce companies. Whether you’re a fast-growing startup or a global enterprise, SEON delivers advanced tools to help you take on fraud and AML compliance challenges.

SEON delivers real-time fraud and anti-money laundering prevention across the entire customer journey — dynamically assessing risk from pre-KYC to onboarding, login to transaction monitoring. Unlike black-box or point solutions, our transparent, API-first platform adapts to every touchpoint with precise, context-aware decisioning.

SEON is often onboarded within days, not months. Our guided process ensures quick setup and immediate effectiveness, allowing teams to see tangible fraud reduction shortly after starting.

Yes. SEON is built to be flexible from the ground up with modular APIs that allow you to pick and mix based on your business needs, while ensuring minimal disruption and instant compatibility with your existing workflows.

Clients typically experience significant reductions in fraud and AML risks within days of deployment. SEON leverages behavioral analytics, real-time monitoring and customizable rules to identify suspicious activity and streamline compliance management proactively.

Yes, SEON delivers a real-time fraud prevention and anti-money laundering solution globally, with offices in London, Budapest, Jakarta and Austin. SEON provides localized support and expertise across Europe, North and South America and Asia-Pacific, helping you fight fraud no matter where your business operates.

SEON is widely used for:

Bonus Abuse & Multi-Accounting

Detects linked accounts using digital fingerprinting and social signal profiling, preventing fraudulent exploitation of promotions, especially in iGaming and eCommerce.

Pre-KYC Screening

Scores risk signals (email, phone, IP) before full KYC checks, enabling early fraud detection and optimizing compliance costs.

Login Monitoring

Identifies account takeovers by analyzing behavioral anomalies and device/browser fingerprints during login events.

Transaction Monitoring

Provides real-time scoring at the point of transaction using a custom rule engine and supervised machine learning to flag suspicious activity before it causes loss.

Onboarding Fraud Detection

Helps verify identity and spot fake or synthetic profiles during account creation using OSINT-enriched data and automated decisioning.

Take the First Step Toward Transformative Fraud Prevention

“SEON significantly enhanced our fraud prevention efficiency, freeing up time and resources for better policies, procedures and rules.”

Chief Compliance Officer, Soft2Bet

Trusted by 5,000+ global organizations:

Book Time With Our Risk Experts

This form may not be visible due to adblockers, or JavaScript not being enabled.