Fighting online fraud is a game of cat and mouse.

Threats and defenses are constantly evolving. You implement a solution; fraudsters find a way around it. You update your tool; they update theirs.

The problem? It can be costly, time consuming, and draining to constantly rush to fix holes in your line of defense. It’s particularly true if your business is growing, or you are in a high risk industry for fraud.

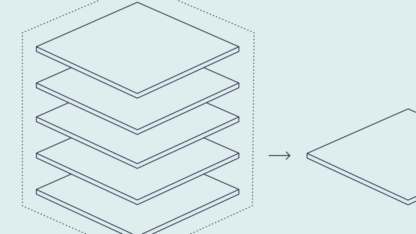

Enter multi layered fraud prevention.

In a nutshell, it allows you to add as many fraud prevention tools as you need, giving you complete control and flexibility over your prevention arsenal.

In this post, we’ll look at what it means in practice, the pros and cons, and three ways your business could implement it today.

How Multi Layered Fraud Prevention Works

In an ideal world, your fraud prevention solution would be powerful enough to evolve, adapt, and meet any kind of new threats.

It should be a complete end-to-end solution that blocks fraudsters, improves your margins, and doesn’t slow down genuine customers with false positives.

But you might still welcome extra help in the form of third party tools. These can be plugins, integrations or external systems that can help in several additional ways.

In any case, it always starts with the main system. This will be your fraud prevention nerve center, where you can plug in extra third party tools. We’ll go into examples of what these integrations look like below.

When One System Isn’t Enough

Unfortunately, for many companies with older, legacy solutions, it’s going to be harder and harder to rely on one tool only.

Here are a few other reasons companies are choosing multi-layered protection instead:

- To enrich the data: A lot of systems let you gather data and analyze it. But you can benefit from sourcing external data in order to learn more about users, starting with single data points such as their emails, for instance.

- To meet scalability issues: If a company is growing fast and its fraud prevention is lagging behind, fraud managers can integrate an external tool to boost the efficiency of the current system without too much disruption.

- To patch holes in the line of defense: Instead of completely rebuilding their fraud prevention systems, some companies will add 3rd party solutions with very specific goals. For instance, a reverse email lookup tool, reverse phone lookup tool or device fingerprinting solution that was originally missing.

- To speed up manual reviews: If you can’t tweak your system to reduce manual reviews, you can add another solution to help. For instance, certain companies use additional tools like plugins that query external databases to get a final say on approving/denying a transaction.

What to Consider Before Stacking Fraud Prevention Tools

While you may believe that more defenses are better, there can be challenges to working with multilayered fraud protection.

First of all, you are increasing the complexity of your system with every addition. It can make life harder for developers and analysts to troubleshoot your stack if things go wrong.

It also means multiplying partnerships – more vendors to deal with, more invoices, and more updates to keep on top of.

Another important point to keep in mind: Does the extra tool work with your region or industry-specific needs? For instance, credit scoring varies wildly depending on where it is calculated in the world. Will you need to educate the vendor about exactly what data you need? Or can you just integrate and start working straight away?

Three Examples Of Multi Layered Fraud Integrations

If you’re considering taking the plunge, here are three examples of how SEON has successfully helped build multilayered fraud protection for its clients.

1. Integrating Modular APIs

Some companies we work with have in-house systems for calculating risk. They do not want to rebuild everything from the ground up, or they are legally required to keep some data to themselves (for instance, with credit scoring).

This is where they can simply feed the results of our modular APIs into their system. This can be their own middleware or even an external risk scoring system, and will improve the accuracy of their scoring through data enrichment.

Integrations like these are easy and fast. However, they work best for companies that have a significant IT and fraud prevention budget, as all the middleware has to be maintained in-house. Analysts are also required to understand and make the most of data mining.

It can also increase costs, as multiple data enrichment providers become involved in sourcing data.

2. Integrating External Data Sources Into Our Platform

For clients who already use SEON’s end-to-end platform as their core solution, we also make it easy to integrate external data via our user_label field. This data will contribute to improving risk scoring or rule generation. It can also create a “network effect”, by sharing risky data with other merchants.

Examples of external data our clients have sourced include name scans for politically exposed persons (PEPs), sanction screening, and ID verification.

This method works well for sourcing simple external data as the level of customization is limited. There aren’t any extra maintenance costs, but your developers will need to build middleware to feed the data into our platform.

3. Manual Review Through External Tools

This case is for companies with an efficient fraud prevention solution (in-house or external), maybe even other vendor integrations – but also a high number of manual reviews. At the manual review stage, you can still enhance your processes by using a third party tool.

Note that this is not technically an integration. Instead, the fraud analyst acts as a bridge between multiple systems to improve efficiency. There is no shared data between the multiple systems. However, from the customer’s perspective, this is one seamless process — and hopefully, one that doesn’t slow down their journey too much.

Key Takeaways

On paper, it would look like adding more layers of prevention yields far more benefits than downsides. But of course, it will come down to a business decision. In that respect, integrations should be assessed just like your initial fraud prevention tool:

- Will it save me more than it costs?

- How fast or complex will the integration be?

- Will it slow down customers by adding friction?

- Is it future-proof or will it prevent me from scaling my systems later?

At SEON, we’re continuously working to make integrations faster, smoother and more cost effective. But remember that remaining informed, whether it’s about the latest attack techniques or cybersecurity tools, is always the best way to stay one step ahead of the fraudsters – and your competitors.